In today’s fast-moving digital finance environment, choosing a banking service that is safe, flexible, and designed around real-life budgeting needs is more important than ever. Current, a rising fintech company, has quickly gained attention for offering a range of innovative tools—from savings and spending features to crypto investing and teen accounts.

But is Current actually worth using? Is it safe? In this comprehensive review, we’ll examine its features, fees, benefits, and overall value so you can decide whether it’s a good fit for your financial goals.

Key Highlights

.Free spending and savings features

.Earn up to 4% APY on as much as $6,000 in savings

.Benefits include early paycheck access, free overdraft protection, and cash advances

.Crypto investing and teen accounts available

.Ideal for users who want to save money, avoid bank fees, and grow their savings

What Is Current?

Current is a U.S.-based fintech company focused on giving users affordable, flexible financial tools without the high fees charged by traditional banks. Originally launched in 2017 as a teen debit card, it has evolved into a full neobanking platform for adults and families.

Although Current is not a traditional bank, it partners with Choice Financial Group and Cross River Bank, both FDIC-insured institutions. This ensures that customer funds are protected up to $250,000.

Current doesn’t separate checking and savings like standard banks. Instead, it offers a hybrid account structure with no monthly fees, no minimum balance requirements, and no credit checks.

Is Current Legit?

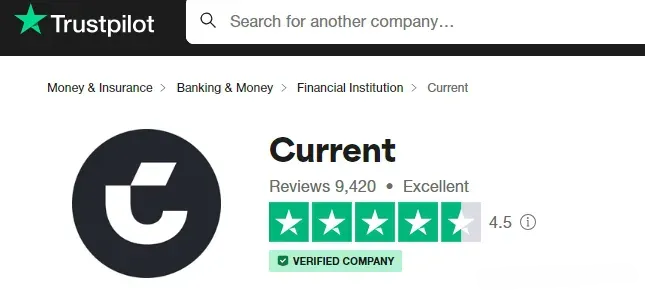

Yes—Current is a legitimate and highly rated neobank.

Its Trustpilot rating is an impressive 4.5 stars, with more than 9,000 reviews praising its ease of use, low fees, and convenient mobile-first design.

Current is especially appealing if you want:

.No hidden bank fees

.Competitive savings interest

.A simple, beginner-friendly financial setup

.Attractive signup bonuses

However, if you hold large cash balances, Current may not be the best choice since it only pays interest on the first $6,000 saved. For higher balances, platforms like Raisin may offer better rates.

What Does Current Offer?

- Current Spend

Current Spend is the core of Current’s banking platform—a hybrid spending account that functions like both a checking and savings account. You receive a Current Visa debit card to make purchases, withdraw cash, and manage your funds.

Key features include:

.Direct deposit with early paycheck access (up to two days early)

.Free overdraft protection (up to $200)

.Free AllPoint ATM access (40,000+ ATMs nationwide)

.Mobile check deposit

.Auto-pay tools

.Credit-building features through the Current Secured Visa

.Up to 7x reward points on eligible debit purchases

.No gas station holds on your card

This all-in-one setup eliminates the need for multiple accounts while still supporting everyday banking needs.

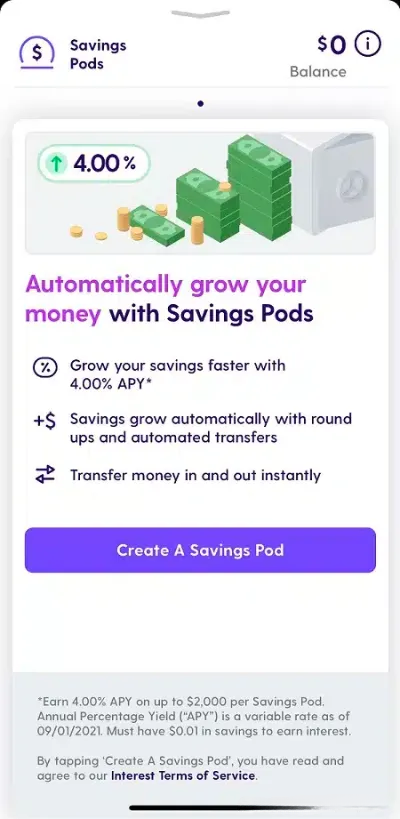

- Savings Pods

Savings Pods are Current’s version of saving accounts. You can create up to three Pods, making it easy to organize savings goals such as vacations, emergency funds, or debt repayment.

Only the first $2,000 in each Pod (max $6,000 total) earns interest, known as Current Boosts:

.Up to 4.00% APY

.Requires at least $500 in qualifying monthly direct deposits

.If requirements aren’t met, the rate drops to 0.25%

Current also offers automated savings via Round-Ups, which rounds debit purchases to the nearest dollar and sends the spare change to Savings Pods.

- Cash Advances (up to $500)

Current allows users to access cash before their paycheck arrives with fee-free cash advances up to $500.

To qualify, you must:

.Set up direct deposit with Current

.Receive at least $500 per month in deposits

As you consistently deposit and use your account responsibly, your cash advance limit can gradually increase.

If you choose immediate funding, a small express fee applies. Otherwise, the fee-free advance arrives within 3 business days.

- $50 Signup Bonus

New users can claim a $50 welcome bonus by:

(1)Opening a Current account

(2)Entering the promo code at sign-up

(3)Receiving at least $200 in direct deposits within 45 days

The bonus is deposited within 10 business days after the qualifying deposit clears.

- Crypto Investing

Current now offers crypto trading directly inside the app, allowing users to buy and sell dozens of digital assets with no trading fees. Supported cryptocurrencies include:

.Bitcoin

.Ethereum

.Dogecoin

.Cardano

.Polkadot

You can start investing with as little as $1. While the interface is simple and beginner-friendly, it’s less robust than dedicated crypto exchanges like Coinbase.

- Teen Accounts

Current also provides dedicated teen accounts. Teens can open their own accounts, while parents maintain oversight and control.

Parents can:

.Send allowance

.Set spending limits

.Monitor activity

.Instantly transfer money

Teens also get a Giving Balance Savings Pod, where they can save money to donate to supported charities—helping build good financial habits.

Current Fees and Pricing

Current has no monthly fees, no overdraft fees, and no account minimums.

However, certain optional services do carry charges:

.Out-of-network ATM: $2.50

.International ATM withdrawals: $3 + foreign transaction fee

.Cash deposits: $3.50 per transaction

.Replacement cards: $5 standard, $30 expedited

.Foreign transaction fees: 3% (or $0.50 minimum)

.Late payment fee: 3% of outstanding balance

.Inactivity fee: $5/month after 12 months

.Account closure fee: $10

These fees are still significantly lower than most traditional banks.

Is Current a Good Banking Solution?

Current is an excellent choice if you:

.Want no-fee banking

.Are building your first savings fund

.Want early paycheck access

.Need occasional cash advances

.Prefer modern mobile banking

.Want an easy way to earn competitive interest

However, it may not be ideal if:

.You prefer in-person banking

.You hold more than $6,000 in savings

.You want advanced investing options (stocks, ETFs, etc.)

Is Current Safe?

Yes. Current is a secure banking platform with:

.FDIC insurance up to $250,000 through partner banks

.Bank-grade encryption

.Strong data protection and privacy controls

Your information and funds are protected to the same level as traditional banks.

Best Alternatives to Current

While Current is a strong overall option, you may want to compare it with:

.SoFi – best signup bonuses

.Raisin – best for finding top savings rates

.Upgrade – best for cashback rewards

.EarnIn – best for cash advances

.Varo – best fully digital bank alternative

Exploring multiple neobanks can help you find the best fit for your goals.

Pros and Cons of Current

Pros

.No monthly account fees

.$50 signup bonus

.FDIC-insured funds

.Free overdraft protection

.Early access to paychecks

.Large ATM network

.Crypto investing and teen accounts

Cons

.Interest applies only to the first $6,000

.$500 daily ATM withdrawal limit

.Crypto tools are basic

.No stock or ETF investing options

Final Verdict

Current is a powerful, user-friendly neobanking solution designed for people who want to avoid unnecessary fees and grow their savings easily. Its 4% APY, early paychecks, cash advances, and generous signup bonus make it an appealing option—especially for new savers or those wanting a simple financial setup.

If you need higher interest limits or in-person banking, you may want to explore alternatives. However, for a free, modern, and convenient savings experience, Current is absolutely worth considering.